Fiji’s economy is now in an unusual place. The recent Reserve Bank of Fiji’s Economic Review shows that most headline indicators are up: construction activity is rising, credit growth is strong, visitor arrivals are steady, and foreign reserves are comfortable at six months of import cover. The economy is heading towards its fourth consecutive year of growth. But the country is experiencing something rarely seen in the region: a broad-based deflation.

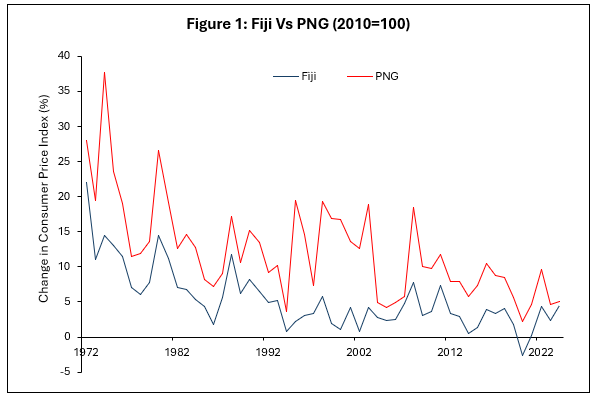

In layman’s terms, deflation is negative inflation. For Fiji, headline inflation in September hits –3.8 percent, continuing its steady slide from –3.5 percent in August and far below the positive four percent recorded last year. Food prices are down eight percent, fuel and transport costs have dropped, and even cooking gas is now cheaper in Fiji. If the trend continues, Fiji could see its second yearly deflationary episode since 1972 (Figure 1). It’s rarely a thing in Melanesian economies, particularly PNG.

Deflation is typically caused by declining money supply and aggregate demand. But this doesn’t seem to hold for Fiji. Range of real-sector indicators are showing that Fiji’s economy is heading strong. First, visitor arrivals are flat overall, a plus of 0.3 percent Year on Year (YoY) change. Arrivals from both the US and UK remain robust at 11 percent. Second, timber production is booming, mahogany, woodchips, and sawn timber saw increase by 90 percent, five prevent and one percent respectively. Third, a reliable gauge of domestic economic activity-electricity generation, edged up again (+0.3% YoY). Fourth, construction continues to accelerate. The value of work put in place is now up by 12 percent, while construction-related imports have increased by five percent.

Then comes the striking strength: household demand. Consumption-related lending jumps by 32 percent, vehicle registrations punch up by 24 percent, and Net Value Added Tax (VAT) collections pump up an additional one percent, even after the VAT reduction. This is not what a deflationary economy typically looks like. Households are spending, credit is flowing, businesses are expanding, and government expenditure remains supportive. Remittances, which are still above one billion dollars, provide a strong and steady base of income. In short, demand doesn’t seem to be a problem.

But why is Fiji in deflation? Three forces could explain this. First is the VAT policy and transport subsidy. In addition to its previous massive 21-item zero VAT policy, the recent VAT policy saw the 15 percent VAT on all the other items got reduced to 12.5 percent. This had an immediate and broad effect on prices. Items most influenced by VAT and the subsidy—food, beverages, fuel, and transport—show the largest declines. Second is cheaper global commodities. The global price cycle has turned downward. Brent crude is down two percent (month-on-month changes (MoM)), at around USD 67 per barrel. And the Food and Agricultural Organization Food Price Index (FAO PI) is down one percent. These declines flow directly into import prices.

Third, is the stronger Fijian dollar. The Fijian dollar appreciated against several key currencies: New Zealand dollars by six percent, Australian dollars by two percent and Japanese yen by one percent. Because Fiji imports a large share of its food, fuel, and manufactured goods, a stronger currency translates quickly into lower domestic prices. The combination of these forces makes Fiji’s deflation, a policy-driven and imported phenomenon.

Moving onto labor market, comes something to be cautious about. Data is showing that Fijian labor market is cooling from a tight post-COVID peak. A leading indicator, job advertisements are down by 10 percent; foreign work permits are down by 86 percent and yet temporary outward migration is down by six percent. Despite these developments, the labor market has not turned negative; wages jumped by 11 percent and formal employment registrations saw an increase of two percent. We can say the labor market is loosening; “contracting” is too early to say.

On the external front, indicators remain strong for Fiji. Foreign reserves are at four billion dollars, a very comfortable level. The trade deficit has widened to three billion dollars, but the composition is encouraging. Imports increase by seven percent, driven by machinery, food, and chemicals; exports surge by eight percent, including stronger gold, woodchips, and kava exports. But there are some weak points worth noting. These include mineral water exports, down by nine percent. Gold ore production is also down, though gold concentrate exports offset some of this decline due to higher global prices (+10% MoM). Remittances continue to cushion the external position, remaining above one billion dollars. Can’t be shy to say, Fiji’s external accounts appear healthy. Given no strong signs of the economy overheating, there is no urgency to tighten policy rates.

For now? Fiji’s 2025 economy pulse is unusual but not unhealthy. The economy is expanding at a steady pace, powered by tourism, construction, remittances, and consumer spending. Prices are falling — not because the economy is weak, but because of tax policy, global price movements and exchange-rate strength. If global conditions remain supportive, the looming cyclone remains at bay, and domestic demand holds, Fiji could maintain this path of steady and moderate expansion. But the implications emanating from the loosening labor market and the deflationary story should be things to watch.

Ref:

- The featured photo is of beautiful Mamanuca Island, taken from Fiji Guide.

- All data in this blog draws from Reserve Bank of Fiji’s Economic Review.

- Data for Figure 1 comes from World Development Indicators (2025). Note that similar long-run time series data for Solomon Islands and Vanuatu are not available, so Figure 1 only shows that of PNG and Fiji.

Leave a comment